B2B Invoicing: All the benefits of electronic invoices for companies

The mandatory adoption of e-invoices in the B2B sector in Germany marks an important turning point in the digital transformation of companies. However, this legal regulation is only the beginning of a widespread optimization process far beyond compliance with legal requirements. Switching to electronic invoicing offers a wide range of benefits, from significant efficiency gains to considerable cost savings. This blog highlights why companies should see the B2B invoicing requirement as a stepping stone towards digitized and efficient accounts payable and how they can take advantage of the law.

B2B Invoicing: All the benefits of electronic invoices for companies

The mandatory adoption of e-invoices in the German B2B sector marks an important turning point in the digital transformation of companies. However, this legal regulation is only the beginning of a widespread optimization process far beyond compliance with legal requirements. Switching to electronic invoicing offers a wide range of benefits, from significant efficiency gains to considerable cost savings. This blog highlights why companies should see the B2B invoicing requirement as a steppingstone towards digitized and efficient AP departments and how to take advantage of the law.

E-Invoicing Mandate: Detailed Advantages of B2B Invoicing

With the legal introduction of e-invoicing starting in January 2027 for larger companies and in January 2028 for smaller companies with a turnover of less than €800,000, it is essential for all economic players to adapt to the digital changes. The gradual implementation of the regulations facilitates the transition for all parties involved and promotes acceptance.

Companies that tackle the switch to digital invoicing processes ahead of time will position themselves at an advantage over their competitors by meeting legal requirements and increasing efficiency and operational performance. B2B invoicing should, therefore, be seen as an integral part of the corporate strategy that goes far beyond a simple compliance requirement.

E-Invoice Mandate: What Companies Need to Know Now

The ongoing digitalization of the business world is changing the way companies operate and bringing new legal requirements. A key aspect of this development is the introduction of…

Read more: Everything you need to know

about the e-invoicing obligation

Optimization of efficiency and cost reduction

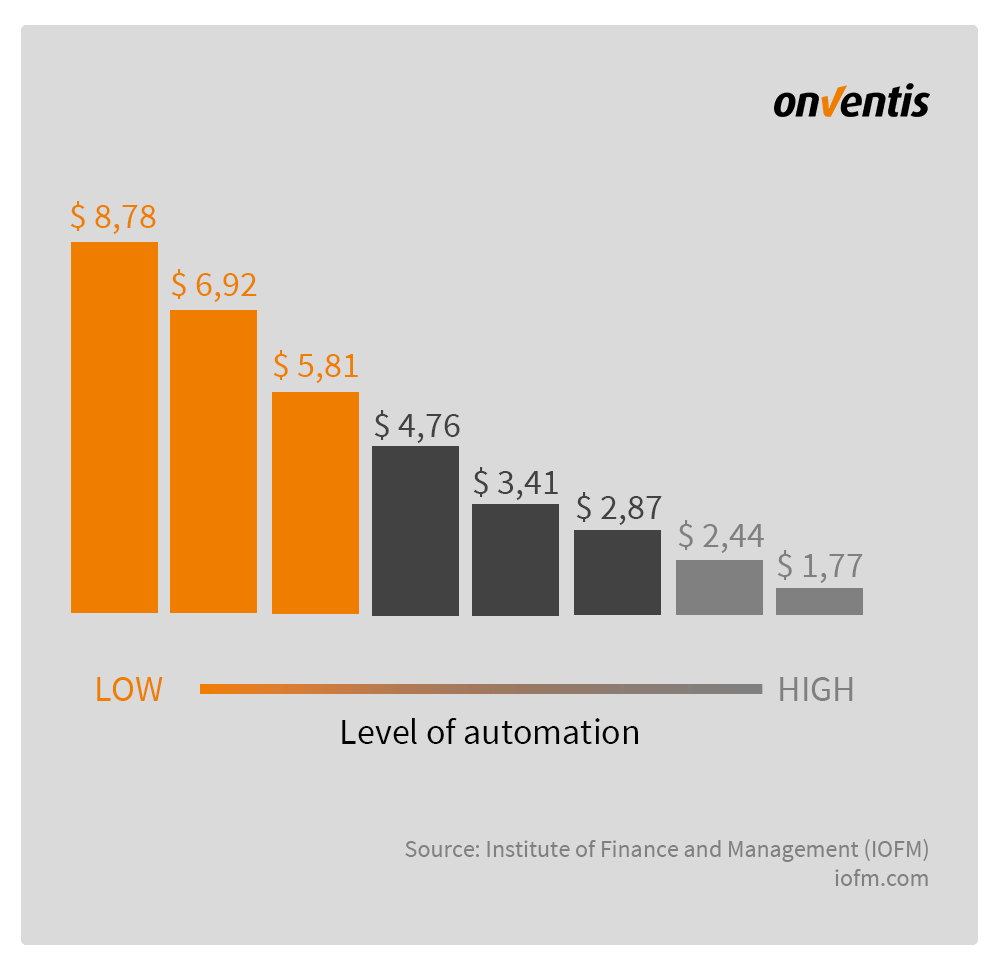

Switching to e-invoicing significantly reduces manual processing. E-invoices are integrated directly into ERP systems, eliminating the need for manual intervention and speeding up the entire process. Integrating e-invoices directly into ERP systems eliminates manual intervention, speeding up the process. According to studies, companies can save up to 70% in costs compared to traditional methods by automating invoice processing. By reducing the time spent on invoice processing, employees can focus on higher value tasks and increase business productivity.

Additionally, there are direct cost savings from reallocating resources. By automating manual processes, finance teams can focus on strategic tasks and address important issues that were previously neglected due to the high effort involved in manual operations. Increased productivity allows for an expanded workload without requiring additional time to complete tasks.

Since 2011, Rotterdam Harbour Holding (RHH) has relied on automated invoice processing by Onventis. As a large international company, RHH handles a high volume of complex purchase invoices. The diversity in invoice formats and the pressure to process them quickly to ensure timely payment posed significant challenges. To simplify and streamline their invoice processing, RHH partnered with Onventis. The Onventis Invoice Processing solution is deeply integrated into RHH’s IT landscape, resulting in a seamless process. Consequently, RHH processes over 111,000 invoices annually with just 1.5 full-time equivalents (FTEs).

Improving payment processes and liquidity

The immediate electronic transmission of invoices significantly accelerates the payment process, thereby reducing processing times and enhancing liquidity. This is especially advantageous during financial uncertainty, as it enables companies to access their capital more swiftly. Moreover, faster invoicing minimizes the risk of payment delays and fosters stronger customer relationships through professional and efficient operations.

Reduction in error rates and improved compliance

Automated e-invoicing significantly reduces the risk of input errors. Any error in invoice processing can lead to delays and additional costs. Digitization also simplifies compliance, as digital invoices are easier to archive and manage, which supports compliance with tax and financial regulations.

Hilton Food Group, a long-standing Onventis customer, has achieved an impressive increase in efficiency with the implementation of the Onventis AP Automation Suite: 80% of their invoices are now automatically processed, eliminating the need for human intervention. With a weekly volume of 500 invoices, about 400 invoices can be processed without any manual intervention. Hilton thus benefits from automation and reduces errors in invoice processing in the long term.

Another advantage of automated invoice processing and the use of e-invoices is compliance, as electronic invoices are easier to archive and check. This minimizes the risk of errors and fraud by enabling seamless, traceable documentation of all invoice transactions.

Sustainability and environmental protection

Reducing paper consumption through e-invoicing contributes to a company’s environmental goals. Less paper consumption means lower costs and a smaller ecological footprint. At a time when sustainability and environmental protection are becoming increasingly important, this is an advantage that should not be underestimated.

Transitional phase of the mandate and PDF invoices

The introduction of mandatory B2B e-invoicing forces companies to adopt digital invoice processing systems for e-invoices. During the transition period from 2025 to 2028, flexible regulations will take effect, enabling a smoother transition to full digital invoicing. During this phase, companies can continue to use traditional paper or PDF invoices alongside e-invoices, depending on their size and with the consent of the invoice recipient.

A hybrid strategy is required to effectively use the time until the changeover is complete and ensure a smooth transition. It is recommended that we strive for uniform and harmonized invoice management by processing paper, PDF, and e-invoices electronically.

The Onventis Invoice Processing solution enables this by managing structured xInvoices AND digital or scanned paper invoices. Each invoice is systematically recorded and compared. Modern technologies and algorithms extract the relevant data from the invoices and prepare them for further processing. In the case of PDF or paper invoices, our OCR-as-a-Service function captures the text of the invoices securely and reliably. These technological advances enable efficient use of the benefits of digital invoice processing, regardless of the invoice format.

As part of a comprehensive digital transformation, these systems enable advanced analyses and provide valuable insights into financial performance. Companies implementing these technologies position themselves at the forefront of digital innovation, enhancing their competitiveness and market flexibility with a robust, scalable, and future-proof invoice processing infrastructure.

RHH, an international company, leverages OCR-as-a-Service to manage its diverse and complex invoicing needs. Receiving invoices in various formats and languages from around the globe, RHH often deals with additional pages containing essential processing information. Each supplier’s unique invoice format adds complexity, making manual data extraction time-consuming and inefficient. Using OCR technology, RHH automates the recognition of critical fields on invoices, streamlining the process regardless of the invoice format and significantly reducing manual effort.

Technologies for Mandatory E-Invoicing

The introduction of e-invoicing in the B2B sector marks a significant milestone in the digital transformation of businesses, offering benefits far beyond mere legal compliance. This blog highlighted how mandatory e-invoicing ensures compliance and delivers substantial operational advantages, including efficiency gains, cost reductions, and the optimization of payment processes and liquidity.

The transition period until 2028 presents companies with a unique opportunity to quickly adapt their systems and processes, securing a decisive competitive edge. The Onventis Invoice Processing solution is crucial in this transition, enabling flexible and efficient handling of all invoice formats – from paper and PDF to electronic invoices. This capability ensures compliance with new regulations while boosting productivity and strategically realigning finance teams.

In addition, digital invoice processing supports sustainable corporate management, reducing the ecological footprint and contributing to environmental goals. Implementing e-invoicing is a strategic decision to promote digital innovation and secure future competitiveness. Companies that embrace this transformation now will benefit from digitized invoice processing and enhance their market flexibility in a rapidly changing economic landscape.

However, software benefits alone are not enough. Transitioning to an automated solution is challenging and takes time. To ease this digital transformation, we have created a white paper that provides comprehensive information on digitizing invoice processing, including essential tips and tricks. Download it now to transform your paperwork into a streamlined invoice-to-pay process!

Whitepaper: Turn the Paper Trail into a Lean Invoice-to-Pay Process

Weitere BlogsMore BlogsMeer blogs